There are two ways to calculate operating cash flow: the direct method and the indirect method, depending on reporting and regulatory compliance requirements. It's the amount your business spends on fixed assets like buildings, computers, other office equipment, machinery and vehicles that will be used for more than one year.

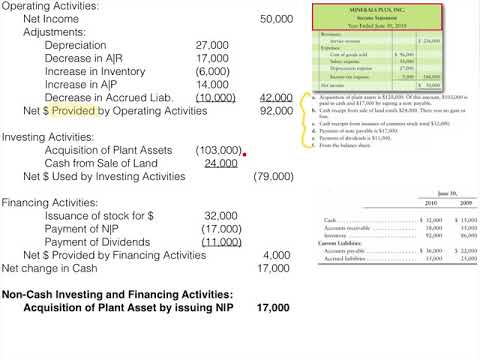

Capital expenditures: You'll find the capital expenditures figure on your statement of cash flow.To calculate the change in working capital, you would find the difference between the current period's working capital and the previous period's working capital. Working capital: Working capital is your business's total current assets minus its total current liabilities, and you can find these figures on your balance sheet.Amortization spreads out the cost of an intangible business asset like a trademark or patent over time. Depreciation is the amount of value your business’s assets (like vehicles or equipment) lose over time. Depreciation and/or amortization: You'll find the depreciation and amortization figures on your income statement.It is the amount of money your business earned during a specific period of time after you deduct all expenses, including salaries, cost of goods or materials, taxes, rent, marketing, advertising and more. Net income: You'll find the net income figure on your income statement.

#Cash flow statement depreciation free#

Reference your company income statement, balance sheet and cash flow statement to find the components that you use in the free cash flow calculation. Net income + Depreciation and/or amortization - Change in working capital - Capital expenditure = Free cash flow The free cash flow calculation should look like this: This amount is added to the net cash from operations amount.Įven though the net income for the business was $2,375 for the month, Patty's Pet Portraits actually has $3,242 in cash entering and leaving. Notes payable: Patty tapped her line of credit for $200.It is deducted from net cash from operations. Purchase of equipment (capital expenditure): Patty purchased $350 in equipment.Net cash from operations: Patty has $3,392 in net cash from operations this month, which is the product of adding and subtracting the previous amounts from net income.This is money owed but not yet paid, so it is added back to her cash on hand. Taxes payable: Patty must put away $62 this month to meet her year-end tax bill.Inventory is not cash, so that amount must be deducted. Increase in inventory: Patty purchased $45 in supplies to use in the business.She had a decrease in accounts receivable, which means an increase in cash. It is added to the cash her business does have. That money has not yet been received, so it is not considered cash. Decrease in accounts receivable: Patty invoiced clients $500.

0 kommentar(er)

0 kommentar(er)